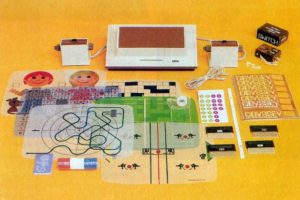

On August 31, 1966, a 44-year-old electrical engineer named Ralph Baer had an epiphany whilst waiting for a colleague outside a New York City bus terminal. For reasons he would never be able to explain, his thoughts turned to the potential of an interactive version of television. The next day, he sat down in his office at Sanders Associates, the defense contractor where he worked as a senior engineer, and wrote down his ideas in the form of a four-page proposal. Over the course of the next four years, amidst many other distracting priorities and much internal politicking, Baer gradually turned his proposal into the concrete reality of a “TV Game” system. Sanders, a company with no experience in marketing consumer electronics, licensed the system to Magnavox, an Indiana-based television manufacturer, in 1971. Magnavox’s engineers then turned the TV Game into the Magnavox Odyssey, which was released in September of 1972 at a price of $100. Thus was the first home videogame console in history born.

That said, the Odyssey lacked many of the things people would soon come to expect from such a beast. Technically, it wasn’t a computing device at all, as it lacked a programmable brain in the form of a CPU. Instead the Odyssey was a solid-state electrical device that was “programmed” by rewiring its innards. Game cartridges were little patch boards that connected its resistors and potentiometers together in different ways, leading to different behaviors. As you might imagine, the number of such viable configurations was decidedly limited. The Odyssey shipped with twelve games that encompassed most of what the system was realistically capable of, ranging from Simon Says to roulette to table tennis. Most of the games relied on external components like screen overlays, scoring pads, and even decks of cards to accompany their primitive onscreen graphical presentations. While Magnavox released a handful of other games for separate purchase, the Odyssey had neither the flexibility nor the sales numbers to create a real “software” market, whether consisting of games published by Magnavox or by others. Best estimates today are that Magnavox sold perhaps a few hundred thousand Odysseys over about a three-year period.

In 1974, Magnavox was acquired by the Dutch electronics giant Philips. Coincidentally or not, the Odyssey was discontinued soon after, having never been viewed as much more than a low-priority curiosity by either Magnavox’s management or the retailers who sold it. It’s since gone down into history in largely the same way — as an historical curiosity, a would-be Atari VCS that was just a little too far ahead of its time.

Or it would have, anyway, if not for a patent for which Baer applied on March 22, 1971. Granted on April 17, 1973, United States Patent 3,728,480 — one of several granted in connection with the Odyssey — would be a thorn in the side of the young videogame industry for more than twenty years. “Do [insert everyday activity here] on a computer” patents, endless debates over slide-to-unlock and rounded corners, billion-dollar judgments… all of the litigious insanity that greets us on the technology-news sites today began with what soon became known in videogame circles as simply the Baer patent — two little words which could terrify videogame executives like few others.

Before we proceed, we should take a moment to review the ostensible definition of a patent. The United States patent statutes in effect at the time of the Odyssey patents explain that they are meant to protect a person who “invents or discovers any new and useful process, machine, manufacture, or composition of matter, or any new [emphasis mine] and useful improvement thereof.” Patents accomplish this by securing for the inventor an exclusive license to the patented technology for a period of twenty years from the patent’s application date or seventeen years from its issuance date, whichever is longer. The adjective “new” in the statute is critical; a patented process must be a genuinely new process. The existence of “prior art” — whether known or unknown to the holder of the patent when the patent was applied for, and whether said prior art was itself ever patented or not — immediately invalidates a patent as soon as it’s proved to have existed. Just as critically, a patent does not protect ideas, only implementations. One can, in other words, patent a specific type of engine installed in a car, but one cannot patent the abstract idea of a horseless carriage itself. [1]My choice of examples isn’t an entirely random one. There is in fact an interesting parallel to the Baer patent from the early days of the automotive industry. In 1895, one George Selden was granted United States Patent 549,160, describing a “safe, simple, and cheap road locomotive, light in weight, easy to control, and possessing sufficient power to overcome any ordinary inclination.” He granted the rights to his patent to an organization called the Association of Licensed Automotive Manufacturers. ALAM in turn demanded a licensing fee from anyone attempting to make a gas-powered automobile, regardless of the other details of its engineering. The organization existed solely for the purpose of litigating and accepting these fees, never manufacturing any products of their own. ALAM thus has a good claim to being the world’s first patent troll.

When Henry Ford began making cars of his own without paying ALAM, the latter went so far as to threaten to sue anyone who bought a Ford automobile. Ford replied that “the art [of the automobile] would have been just as far advanced today if Mr. Selden had never been born.” At last, the Ford Motor Company won their case against ALAM on appeal in 1911. The patent was due to expire the following year anyway, but the case did create an important legal precedent that would sadly be often neglected with the coming of the computer age. Both of these qualifications were in place well before the advent of the computer age, yet for some reason courts have often struggled markedly to apply them correctly and consistently in the realm of digital technology. In the case of the famous — some would say infamous — Baer patent, there is good reason to question the courts’ decisions on both counts.

In 1974, shortly before Philips acquired them, Magnavox instituted an intermittent hobby of suing videogame makers over the Baer patent. They alleged that Atari had infringed on the patent with their Pong videogame. Although the Atari machine still didn’t have a CPU and only played the one game, internally at least it was a much more advanced piece of technology than the Odyssey, built using integrated circuits — i.e., chips — rather than the discrete components of Baer’s gadget. For this reason, there could be little question of Pong infringing on the specific implementation of a videogame console described in the Baer patent, a point Atari initially argued with gusto. In reply, Magnavox made the audacious argument that the implementation didn’t really matter in this case. In apparent defiance of the patent statutes themselves, they claimed the Baer patent really did apply to the idea of a videogame, evoking in their defense the fuzzy legal concept of a “pioneer patent”: a process or device so genuinely new and groundbreaking that it should be afforded an unusual amount of leeway by the court when it comes to determining what is abstract idea and what is concrete implementation. The pioneer patent is that most dangerous thing in law, an amorphous abstraction rather than an absolute stipulation. No patent is stamped with a “P” for “pioneer” when it’s granted, and the law has no clear mechanism for dividing patents into “pioneering” and “non-pioneering” categories thereafter. Officially, pioneering patents barely exist at all. Instead, the court system prefers to speak of, as legal scholar Alan L. Durham puts it, “a spectrum that embraces various degrees of inventiveness,” with the pioneer patent enjoying “a potentially broader scope of equivalence because it is not hemmed in by large numbers of similar inventions in the prior art.” In such vagueness lies potential madness.

After acquiring Magnavox, Philips continued to pursue patent-infringement cases against Atari and others. Supported enthusiastically by Ralph Baer, who now stood to gain millions from his old TV Game, Philips rode the nebulous concept of the pioneer patent hard. Baer’s own take on what his patent should cover was stunningly broad. “Our patents,” he would always insist, “dealt with the interaction between machine-controlled and manually-controlled symbols onscreen. If there was a change in the path, direction, or velocity of the machine-controlled symbol immediately after ‘contacting’ — i.e., coming into coincidence with — one of the manually-controlled symbols onscreen, then the game exhibiting these functions infringed our patents.” Not only would such a description have to encompass just about every graphical computer or videogame ever made, one could even imagine it being applied to the non-game GUI-based computer operating systems that began to appear in the 1980s, which relied on manipulating symbols on the screen through “contacting” them with the mouse cursor.

There was, however, a huge danger for Philips in claiming that essentially every videogame should be covered by the Baer patent. The painful fact was that the Magnavox Odyssey, while it was indisputably the first home videogame console, was far from the first videogame, full stop. The two most obvious and incontrovertible examples of prior art were Tennis for Two, a game built by American physicist William Higinbotham for play on an oscilloscope in 1958, and Spacewar!, a game programmed by a trio of MIT hackers for play on a DEC PDP-1 minicomputer equipped with a vector-graphics terminal in 1962. In other words, if Baer’s patent truly applied to every videogame ever then it should never have been granted at all. To head off this line of attack, Philips engaged in a careful exercise in triangulation. Having begun their argument by implying that the Baer patent should cover every videogame, regardless of the details of its technical implementation, they concluded it by stipulating that it should only apply to videogames that were played on ordinary television or monitor screens. Did they want to have their cake and eat it too? Perhaps, but they would be remarkably successful in court.

Atari elected to settle out of court before the case was decided, agreeing to pay Philips to license the patent. It’s very possible that Nolan Bushnell, Atari’s founder and president, may have seen the deal as counter-intuitively beneficial to his own company. Atari was doing very well, and could afford to pay off Philips. The many would-be competitors who were now attempting to get into the same videogame space, however, had shallower pockets and far less clout to negotiate a favorable deal of their own with Philips. And, indeed, a whole clutch of small companies which Philips elected to sue during this period were driven out of the business, unable to muster the resources to even begin to mount a defense against a company the size of Philips. Here we can already see in action one of the most nefarious effects of patent law as it too often gets applied in the modern economy: the way patents get used not, as originally intended, by the little guys to protect themselves against the rapaciousness of more powerful forces, but by said more powerful forces to keep said little guys out. From the date of Atari’s settlement forward, the only companies introducing new home-videogame consoles in the United States would be big, established ones who could, like Atari, afford to reach an accommodation with Philips: companies like Coleco, Milton Bradley, and Mattel. (The last did try to fight the Baer patent in court on behalf of their Intellivision console, but legal precedent was now against them; they lost and agreed to pay up like the others.)

In September of 1982, Philips, now receiving payments from all of the makers of videogame consoles, decided to broaden the field further by suing for the first time a maker of videogame software. They chose for their first target Activision, the most famous and successful of all the third-party makers of Atari VCS cartridges. Activision conducted the most spirited and determined defense yet. Motions and counter-motions flew back and forth for years, while the industry surrounding the two warring parties changed greatly. The Great Videogame Crash of 1983 meant the end of most of Philips’s steady income from the patent licensees, leaving them more motivated than ever to wrangle as large a sum as possible out of Activision for their alleged transgressions of the boom years. At last, on March 17, 1986, the verdict came down in Philips’s favor; case-law precedent, which was well-established by now for the Baer patent, is a difficult thing to fight. Still, in a bid to buy some more time if nothing else, Activision filed their motion to appeal the very next day.

As the case continued to grind through the courts, much change came to Activision. In January of 1987, the company’s founder Jim Levy, after struggling for years to remake his erstwhile purveyor of Atari VCS action games into a purveyor of artsy and innovative computer games, was dismissed by a board that was frustrated by years of ugly losses. Stepping into his shoes was Bruce Davis, who promised the board a return to profitability by retrenching and refocusing on proven genres in proven markets.

We’ve already had considerable opportunity to observe Davis as head of Activision, especially in the context of his troubled relationship with Infocom, the text-adventure specialist whose acquisition had been one of his predecessor’s last major moves. In the beginning, Davis delivered on his promise to Activision’s board to start the company making money again. Activision announced their first profitable quarter in four years just six months after he took over, and continued to be modestly but consistently profitable for the two years that followed. Yet he accomplished the turnaround in ways that seemed almost willfully crafted to be as uninspiring as possible. Davis took to talking about Portal, the innovative “electronic novel” that this humble writer still considers one of the most interesting things any incarnation of Activision ever released, as his number-one exemplar of the sort of product Activision wouldn’t be green-lighting in the future. My fellow historian Alex Smith characterizes Davis’s strategy as the pursuit of “a steady stream of low-level successes rather than high-quality, high-risk, high-reward software.” In terms of games, this meant a series of middling titles, as often as not licensed from whatever media properties were reasonably trendy but not too expensive, that were often competent but seldom exciting — like, one might say, Bruce Davis himself. Like too many gaming executives before and after him, he thought of games as commodities, not creative works. To be fair, he did push his company into HyperCard applications and CD-ROM early enough to count as a pioneer, but in other areas his views were consistently regressive rather than progressive. His views on games for women read as particularly unfortunate today; he said women would never be a viable market due to vaguely defined “profound” differences he claimed to exist between the sexes. In much of this, Davis, lacking any personal engagement with his company’s products, was a slave to the conventional wisdom of the stock analysts and financiers.

While few found him as personally unpleasant as his growing reputation as the most soulless of chief executives might suggest, the aspect of Davis’s character that most consistently frustrated those who worked with and for him was his tendency to make sweeping unilateral decisions without consulting them. Combined with what often seemed a somewhat shaky grasp of basic human nature, it could make for a toxic brew. For instance, there was his unilateral decision to demand hundreds of thousands in reparations from some of the most important figures still working at Infocom for allegedly misrepresenting the value of their company before its sale to Activision. Davis seemed nonplussed when it was pointed out to him that this might affect morale and thus the performance of the already troubled subsidiary.

By far the most widely mocked of Davis’s unilateral decisions was that of changing the name of Activision in May of 1988 to Mediagenic. He claimed the new name would free the company of the baggage of its storied early years, would emphasize that this latest incarnation was far removed from the one that had so successfully sold videogame cartridges to Atari VCS owners in the early 1980s. After all, the newly christened Mediagenic now sold a much wider range of entertainment software for computers as well as consoles, and was moving beyond games as well into creativity and productivity software. Of course, what Davis labeled diversification, others might label a lack of any coherent focus. Seen in this light, the name change was emblematic of a company that did indeed seem to have lost its very identity, that was trying to do a little bit of everything without doing any of it particularly well. With few to no products worth getting really excited over, Mediagenic’s catalog was a dismayingly anonymous collective. “We have a lot of legs to stand on,” said Davis. Perhaps a few too many. The name change succeeded only in making him and his company the butt of constant jokes for the rest of his tenure. William Volk, who worked at Activision/Mediagenic at the time, told me that the consensus there among everyone not named Bruce Davis was that the name change was “the stupidest decision in the world”: “We hated the name, we called it Mediumgenitals.”

But perhaps an even more damaging manifestation of Davis’s unilateral tendencies was his handling of the Philips lawsuit, which continued to hover over Mediagenic throughout his tenure like a Sword of Damocles. Stan Roach, one of those who reported directly to Davis, believes that Davis felt his background as an intellectual-property attorney qualified him to take exclusive responsibility for the management of the case. In May of 1988, just days after the name change was announced, Mediagenic’s appeal of the Baer patent case was rejected by the U.S. Circuit Court of Appeals, and the case moved on to the damages phase. Davis continued to play his cards so close to the vest thereafter that when the damages verdict arrived in March of 1990, everyone was shocked to discover it was more than large enough to constitute an existential threat. An atomic bomb no one had seen coming had just been dropped on them out of a clear blue sky.

The timing could hardly been much worse; at that point, Mediagenic’s bottom line was already looking pretty ugly. Although they were still roughly breaking even in terms of day-to-day sales, Mediagenic over the course of 1989 had written off a pile of Davis’s more unprofitable ventures, such as the TenPointO productivity line, whose name made “Mediagenic” sound like a stroke of marketing genius. And, most damagingly, they had finally closed the Infocom subsidiary Davis had never really wanted in the first place, a move which alone carried with it a hit to the bottom line of some $5 million. It all came as part of yet another of Bruce Davis’s unilateral moves. With all of Mediagenic’s products in the field of non-gaming software and, indeed, in the field of computer software in general under-performing, he had decided to return his company to its roots as a maker primarily of cartridge games. “PCs will never have the penetration into homes that videogames do,” he said, citing the cheaper price and greater ease of use of the consoles. While he wasn’t wrong to take note of those factors, which were indeed doing much to make the Nintendo Entertainment System one of the most successful consumer-electronics products in the history of the American consumer economy, Mediagenic’s tepid stable of games had little chance of seriously competing on the Nintendo against the likes of Zelda and Mario. Nevertheless, in October of 1989 Davis said that he intended to pull entirely out of all products other than games. That this move came less than eighteen months after the name change to Mediagenic that had been made to facilitate the exact opposite strategy — to establish a new identity as a maker of a wide range of software — must be one of the more damning indictments of his overall leadership.

In executing the pivot, Mediagenic would take the initial financial hit that must result from it in a single fiscal year, then hopefully be set to grow again thereafter. For fiscal 1990, which ended on March 31, 1990, Mediagenic was therefore set to register a loss of some $13 million, about three times as much as all of the profits Davis had so far managed to realize during his tenure. And then, with just days remaining in the fiscal year, the final verdict on damages in the Philips case came down. Mediagenic was punished resoundingly for their earlier refusal to settle. They were to pay a lump sum of $6.6 million to Philips for violating the Baer patent — money they simply didn’t have.

Mediagenic’s only alternative was to negotiate with Philips for leniency on the terms of payment, but the prospects for the latter’s forbearance looked to be decidedly limited. Offered an ownership stake in Mediagenic in lieu of cash, Philips refused. By this point, Philips had launched yet another patent lawsuit, this time against Nintendo, the new 800-pound gorilla of the videogame industry. Many inside Mediagenic believed that Philips was determined to play hardball, was willing to completely destroy Mediagenic if necessary, in order to set an example for Nintendo of what happened to those who didn’t reach an out-of-court settlement. [2]The story of the lawsuit Philips launched against Nintendo is a fascinating one in its own right, if a little far afield from my usual focus on computer rather than console games. It’s fairly well established, if largely only circumstantially, that Nintendo agreed to license their Zelda character to Philips for use on the Philips CD-I — an action that was so out of character for Nintendo as to read as inexplicable by any other light — as part of a settlement. (My fellow historian Alex Smith recently asked Howard Lincoln of Nintendo of America about this; Lincoln said the story does jibe with his recollection.) Even more interestingly, if also more speculatively, William Volk, formerly of Mediagenic/Activision, believes that the settlement barred Nintendo from making a CD-based product alone or in partnership with anyone other than Philips for a certain period of time. This in turn blew up a plan Nintendo and Sony had hatched to make a CD add-on for Nintendo’s consoles, leading Sony to make their standalone PlayStation console instead. It also explains why Nintendo in 1996 made the Nintendo 64 a cartridge-based console when everyone else had moved to CDs; the settlement barred them from following suit. At any rate, the best Mediagenic’s negotiating team could manage was to get Philips to let them defer payment for two years, until 1992, whereupon they could pay in installments of $150,000 per month. Yet even that act of mercy cast a huge pall over the company’s future; $150,000 was an awful lot of money for any business — much less a moribund one like Mediagenic — to give away for no return month after month. Lenders, already made skeptical by Bruce Davis’s strategic U-turns alongside his company’s stagnant sales, refused to grant the credit he needed to complete the restructuring necessary to finish implementing his latest plan. Caught out on a limb, Mediagenic went into free fall, defaulting on creditor after creditor as product development came to a virtual standstill. With little new to sell, their sales dropped from $64.1 million in fiscal 1990 to $28.8 million for the year ending March 31, 1991, leaving them worse off than ever even as the clock continued to tick down on the fateful day when they would have to start making payments to Philips.

When a company as large and important as Mediagenic had become to their industry collapses, it never does so in isolation. Among the people Mediagenic suddenly weren’t paying was their network of so-called “affiliated labels,” smaller publishers who sold their products through Mediagenic’s large, well-established distribution network. These publishers would deliver product to Mediagenic, who would then pay them for it — minus their fee, of course — after selling it on to retail stores. Amidst the chaos of 1990, the second part of that arrangement never happened. Brian Fargo of Interplay, one of Mediagenic’s affiliated labels, described to me the snowball effect that ensued for his company.

It was a double whammy. Imagine this. We ship $500,000 worth of product to Mediagenic, and they turn around and ship it to retail. Mediagenic doesn’t pay me the half a million; they may or may not have gotten paid by retail. Who knows, right? Then I go to the retailers and say, “Mediagenic’s going out of business, so we’re going to go direct now.” They say, “Great! We’ve got half a million dollars worth of your product here.” We say, “Yeah, we know, but we already didn’t get paid for that once.” They say, “Well, you’ve got to take it back from us if you want to continue to do business with us.” So I had to eat my product twice. That almost wiped us out.

Fargo says that Interplay almost certainly would have gone down as collateral damage if not for a new game called Castles, the first they released after leaving Mediagenic, which became a big hit: “Castles saved the company.” Other affiliated labels, such as the Amiga specialists MicroIllusions, weren’t so lucky, going under even as Mediagenic still straggled on, at least ostensibly alive.

Outside developers who created software for publication under Mediagenic’s own imprint were likewise caught in the undertow. When Mediagenic stiffed the Miller brothers of Cyan Software, it very nearly marked the end of their illustrious careers in game development when they had barely begun to show their potential. Thankfully, they would find a way to pull it together and make Myst, by some measures the most successful single computer game of the 1990s, for Brøderbund. Had that game come out on the Mediagenic label, it would single-handedly have solved the problem of the Philips judgment. But then, a Mediagenic Myst would have been unlikely under Bruce Davis; the Miller brothers have told of how they kept asking Mediagenic for permission to make an adult game instead of children’s titles long prior to Myst, only to be told to “stick to children’s games.”

By December of 1990, Mediagenic’s affiliated labels and outside developers were all gone along with most of the company’s other business relationships. Mediagenic was foundering in a sea of red ink, with a bottom-line loss for the year of $19.7 million, and was about to be de-listed from the stock exchange as a lost cause. Seemingly the only question remaining was when and how the inevitable liquidation would happen. It’s at this fraught point that there enters into our story an unexpected wildcard in the form of one Bobby Kotick.

In later years, Kotick would become perhaps the foremost living embodiment of modern mainstream gaming, with its play-it-safe big-bucks ethos of sequels, franchises, and strict lines between genres. Kotick’s habit of saying publicly what many other gaming executives are only thinking has made him a lightning rod for people who would like to see more innovation and thematic ambition in games. One might be tempted to lump him into the same category as Bruce Davis, with whom his general philosophy of business initially seems to have a lot in common, but to do so would be to ignore a very fundamental difference: Kotick, whatever one personally thinks of the games his company releases, has shown an undeniable knack for making games that huge masses of people want to buy. He’s as celebrated by the business press as he is vilified by the artsier corners of the gaming world; he could likely wallpaper his doubtless spacious house with all of his awards from the likes of Forbes, Harvard Business Review, and Inc. How could the business press not love him? He turned a $440,000 investment into a $4.5 billion company in 25 years.

When he trod unto the scene of the slow-motion Mediagenic car crash, however, Bobby Kotick was just a fast-talking 27-year-old go-getter with outsize ambitions. Tender though he was in years, he was already a hardened veteran of the technology business. He had kicked around the home-computer industry for much of the 1980s, using glibness, persistence, and sheer force of personality to win him access to people that would never have glanced twice at him on the basis of his paltry experience and education. In 1987, in a truly audacious move for a 24-year-old, he had tried to put together a package to buy Commodore in order to market the Amiga the way it deserved. Laudable though that goal was, Irving Gould, the crusty old Canadian financier who owned most of the stock at Commodore and ultimately called all the shots, soon sent the young interloper packing. Three years later, he had been involved in lots of small deals, but was still looking for that elusive big break. In the meantime, he and a pair of partners named Brian Kelly and Howard Marks had incorporated themselves under the name of BHK, and were making investments here and there. Observing Mediagenic’s sorry state, they decided to make their biggest one yet.

BHK bought up the 25 percent of Mediagenic’s shares owned by Imasco Venture Holdings, a consortium of investors who were now all too eager to sell, for a cost of just $440,000. The price they paid was as good a measure as any of just how far Mediagenic had fallen; it meant that the entire company was now theoretically worth less than $2 million. BHK’s initial plan for their investment is a little unclear. One reader has told me of sharing a car with Bobby Kotick on the way to an E3 event many years later when the latter was apparently in an unusually candid mood, even for him. Kotick, says my reader, confessed on that evening that he originally didn’t think there was much of anything left worth saving at Mediagenic, and that BHK first bought the shares strictly as a tax write-off. According to this version of events, only after looking more closely at the company they’d bought into and observing the allure that still clung to the old Activision name among gaming veterans did he begin to think that the planned tax write-off might in fact be the shot at the big time he’d been looking for for so long.

Regardless of the original motivation for the purchase, what happened next is better understood. BHK now constituted the largest single owner of Mediagenic stock, and decided to use that leverage in what amounted to a hostile-takeover bid. They showed the other shareholders that they could secure another $5 million in cash and credit, and that they had hammered out an agreement in principle with the major lenders to exercise some forbearance in their collections efforts. BHK was willing to use these things to keep Mediagenic’s doors open, at least for now, on one condition: Bruce Davis and the rest of his management team would have to go, to be replaced by BHK’s own, with Bobby Kotick in the CEO’s chair and Brian Kelly as CFO. The shareholders quickly agreed. After all, the only alternative that remained was immediate liquidation, which would net them virtually nothing, and they had little loyalty left to Bruce Davis, the man they accused — and not without cause — of having badly mismanaged Mediagenic from well before the patent judgment that had proved the proverbial last straw on the camel’s back. On February 22, 1991, Davis stepped down and Kotick stepped up. He controlled Mediagenic; now he just needed to save it. “Given the company’s bleak and deteriorating financial condition, basically this is a turnaround situation,” he said to the press in the understatement of the year.

He knew that the turnaround was dead in the water if he couldn’t work out something with Philips. His first significant act as CEO was therefore to meet with them. The only way you can possibly get paid anything at all, Kotick told them, is if you agree to accept equity in lieu of cash. Once again, Philips flatly refused, whereupon Kotick dropped his key card for Mediagenic’s offices on the table and walked. “Good luck,” he said on his way out the door, convinced he would have to liquidate Mediagenic for the tax write-off after all. Less than thirty minutes later, Philips called him to tell him they would take the equity. (Bruce Davis believes that Philips agreed to the deal because Steve Wynn, a casino mogul who had been something of a mentor to Kotick, called in some favors with friends on Philips’s board, but this remains speculative.)

Kotick slashed the employee rolls, already down to 100 at the time of the takeover from a high of 250 a couple of years before, to just 25 by the end of 1991. He negotiated a lump-sum payout to get out of Mediagenic’s lease of a large Silicon Valley office park, taking a cramped hole of a place in Los Angeles instead. But he wouldn’t be able to cost-cut his way out of the crisis; the company remained fundamentally insolvent. “As much as I’d like to think I provided some grand vision,” Kotick later said, “our first year we were pretty much blocking and tackling.” He watched parts of the company literally disappearing around him each week, as creditors showed up to reclaim equipment that hadn’t been paid for.

So, it quickly became obvious, if it hadn’t been so from the beginning, that $5 million wasn’t going to be enough to set things right. There was only one possible way out of this mess. Using all of his considerable powers of persuasion, Kotick finalized the terms of a Chapter 11 bankruptcy — i.e., a bankruptcy constituting a reorganization rather than a liquidation — with Mediagenic’s creditors in November, getting most of them, as he earlier had Philips, to accept equity stakes in lieu of cash they would never see anyway if the company was allowed to fail entirely. (As “the Bandito,” Amazing Computing‘s rumor columnist, wryly put it, “You’re doing so bad they have to let you keep going.”) The previous stockholders would be left with just 4.2 percent of the company, the rest going into the hands of the likes of Philips, Nintendo (Mediagenic owed them millions for cartridges Nintendo had manufactured but never been paid for), and Sony Pictures (Bruce Davis’s mania for licenses had come home to roost in the form of huge outstanding bills for the licensed games). The company emerged from bankruptcy the next year, leaner and humbled but ready to make a go of it again under their dynamic young CEO. Best of all, the company emerged from the bankruptcy as Activision again rather than Mediagenic. Everyone preferred to forget that the ill-advised name change had ever happened. What with plenty of lenders willing to defer but not to forget much of the rest of what had happened during the Bruce Davis years, it was still going to be an uphill climb. Yet for the first time it was starting to look like they might just have a fighting chance.

In the most literal sense, then, Activision — we too can go back to using that name again! — never died at all, which perhaps makes this story a little out of place amidst this series of articles about endings. Yet the trauma the company went through was so extreme, and the remaking it would undergo under Bobby Kotick so complete, that I trust no one will look too askance at its inclusion here. The Kotick-led version of Activision — Activision 4.0, we might say — was headquartered in a different city entirely, and would employ only a handful of the same people. We’ll take up the continuing story of Activision 4.0, that most unlikely of phoenixes, later on.

In the meantime, what shall we say in closing about the pre-Kotick Activision? Certainly the final finanical reckoning isn’t terribly kind; the company ran a loss for six of its eleven years of existence. After those first few golden years when the Atari VCS was king and Activision 1.0 made the best games for the system, bar none, Activision could never seem to settle on an identity and make it stick. The occasional interesting title aside, neither Jim Levy’s Activision 2.0 nor Bruce Davis’s Activision 3.0 ever felt truly relevant in any holistic sense. Davis’s small-ball approach in particular only served to prove that you really do need to swing for the fences every once in a while.

But rather than continue to poke and prod the muddled history of Activisions 2.0 and 3.0, let’s consider one last time the patent judgment that — whilst giving due deference to all of Bruce Davis’s mistakes — ultimately did them in. It’s rather blackly amusing to consider that the lawsuit which took out Mediagenic and made collateral damage out of so many affiliated labels and outside developers should have come from Philips, who were busy at the same time screwing over another huge swathe of the American games industry with their vaporware CD-I platform. So, here we see yet more of the reasons that so many people who were around the industry in the late 1980s and early 1990s lapse into a stream of curses even today at the merest mention of the name of Philips. Philips couldn’t have done a better job of sowing chaos and discord had they been a double agent hired by Nintendo to complete the destruction of the last of their console’s competition on home computers. But, sadly, the fact that Philips also sued Nintendo rather puts paid to that rather delightful conspiracy theory, doesn’t it?

In the end, the Baer patent netted some $100 million for Philips by Ralph Baer’s own estimation — not a bad financial legacy for the Magnavox Odyssey, a commercially middling (at best) product they inherited and soon cancelled. Baer himself was rewarded with a substantial piece of each settlement negotiated or lawsuit won, and remained to the end of his life unapologetic, claiming what he had received was only his just rewards. While I respect the man’s huge achievements in the field of videogames as well as other areas of electrical engineering, I must say that I don’t agree with him on this point, and must admit that the legal ugliness does somewhat taint his legacy in my eyes. None of the home-videogame systems that followed the Magnavox Odyssey bore much of anything in common with it technically, while the evidence that it directly inspired to any appreciable degree anything that followed is uncertain at best. Of course, it’s also true that Bruce Davis, who had quite a wide litigious streak of his own, doesn’t necessarily make for the most sympathetic of victims. And yet it’s still worth asking whether he deserved to see his company ruined over a videogame console that hadn’t been sold in fifteen years, just as in the bigger picture it’s worth asking what the $100 million Philips made off the Baer patent was really rewarding them for. While we’re at it, it may also be worth asking how different a place the world would be today if, say, Vint Cerf and Bob Kahn had chosen to go the route of Ralph Baer and Philips, had chosen to patent and aggressively protect their TCP/IP protocol that underpins the free and open modern Internet — or if Tim Berners-Lee had done the same to the Hypertext Transfer Protocol that sits atop it.

Unfortunately, questions like these will continue to crop up with distressing frequency as we continue on this little voyage through computer history. And more’s the pity, my friends… more’s the pity.

(Sources: San Francisco Chronicle of May 18 1988, May 25 1988, October 4 1988, October 29 1988, November 14 1988, November 22 1988, January 17 1989, May 15 1989, November 2 1989, March 16 1990, May 5 1990, June 2 1990, September 29 1990, November 1 1990, January 11 1991, January 23 1991, February 27 1991, July 11 1991, October 5 1991, and December 2 1991; San Jose Mercury News of July 27 1987, January 8 1988, January 27 1988, May 14 1988, May 15 1988, May 18 1988, and October 20 1989; Sierra News Magazine of Autumn 1989; Questbusters of April 1991, July 1991, and August 1992; Compute! of January 1989; New York Times of January 25 2004; Amazing Computing of April 1989, August 1989, June 1990, July 1990, January 1991, December 1991, and April 1992; the books Patent Law Essentials: A Concise Guide by Alan L. Durham and Monopoly on Wheels: Henry Ford and the Selden Automobile Patent by William Greenleaf. Online sources include an article on Gamasutra; the articles “By Any Other Name,” “The Baer Essentials,” and “A Magnavox Odyssey” on Alex Smith’s videogame-history blog; United States Patent 3,728,480; an archive of documents relating to the Baer patents and especially the Philips v. Magnavox suit at the University of New Hampshire School of Law; Robyn Miller’s GDC 2013 postmortem on the making of Myst. My thanks go to William Volk and Brian Fargo for very enlightening interviews about these times. My thanks to Yeechang Lee, an investment banker who told me about a very interesting conversation he had with Bobby Kotick. And my huge thanks once again go to Alex Smith, who shared the fruits of his own research in these subjects, among them Mediagenic’s 10K financial statements for fiscal 1990 and fiscal 1991, a summary of his interview with Bruce Davis, and his own valuable insights. The last notwithstanding, it should be understood that this article’s final judgments on the Ralph Baer patent, Bruce Davis, and everything and everyone else are my own alone, so don’t send your hate mail to Alex!)

Footnotes

| ↑1 | My choice of examples isn’t an entirely random one. There is in fact an interesting parallel to the Baer patent from the early days of the automotive industry. In 1895, one George Selden was granted United States Patent 549,160, describing a “safe, simple, and cheap road locomotive, light in weight, easy to control, and possessing sufficient power to overcome any ordinary inclination.” He granted the rights to his patent to an organization called the Association of Licensed Automotive Manufacturers. ALAM in turn demanded a licensing fee from anyone attempting to make a gas-powered automobile, regardless of the other details of its engineering. The organization existed solely for the purpose of litigating and accepting these fees, never manufacturing any products of their own. ALAM thus has a good claim to being the world’s first patent troll.

When Henry Ford began making cars of his own without paying ALAM, the latter went so far as to threaten to sue anyone who bought a Ford automobile. Ford replied that “the art [of the automobile] would have been just as far advanced today if Mr. Selden had never been born.” At last, the Ford Motor Company won their case against ALAM on appeal in 1911. The patent was due to expire the following year anyway, but the case did create an important legal precedent that would sadly be often neglected with the coming of the computer age. |

|---|---|

| ↑2 | The story of the lawsuit Philips launched against Nintendo is a fascinating one in its own right, if a little far afield from my usual focus on computer rather than console games. It’s fairly well established, if largely only circumstantially, that Nintendo agreed to license their Zelda character to Philips for use on the Philips CD-I — an action that was so out of character for Nintendo as to read as inexplicable by any other light — as part of a settlement. (My fellow historian Alex Smith recently asked Howard Lincoln of Nintendo of America about this; Lincoln said the story does jibe with his recollection.) Even more interestingly, if also more speculatively, William Volk, formerly of Mediagenic/Activision, believes that the settlement barred Nintendo from making a CD-based product alone or in partnership with anyone other than Philips for a certain period of time. This in turn blew up a plan Nintendo and Sony had hatched to make a CD add-on for Nintendo’s consoles, leading Sony to make their standalone PlayStation console instead. It also explains why Nintendo in 1996 made the Nintendo 64 a cartridge-based console when everyone else had moved to CDs; the settlement barred them from following suit. |